Things To Do On An Annual Basis

LivingPower Newsletter, Jan./Feb. 2023

As 2023 began, no doubt many of you made New Year’s Resolutions, and probably a few of those resolutions have already been broken. But resolutions don’t have to be life-changing nor do they have to begin with the start of the new year. There are many things you can do throughout the year to improve the quality of your life. The following are a few items that can be done during the year that can make your life better and possibly healthier.

- Clean your closet and drawers and get rid of anything you haven’t worn in at least a year, anything that doesn’t fit you, or anything that is too worn or ripped to repair. Donate what you can.

- Visit the last town you lived. Remember why you don’t live there anymore. Feel grateful for what you have in comparison to what you had.

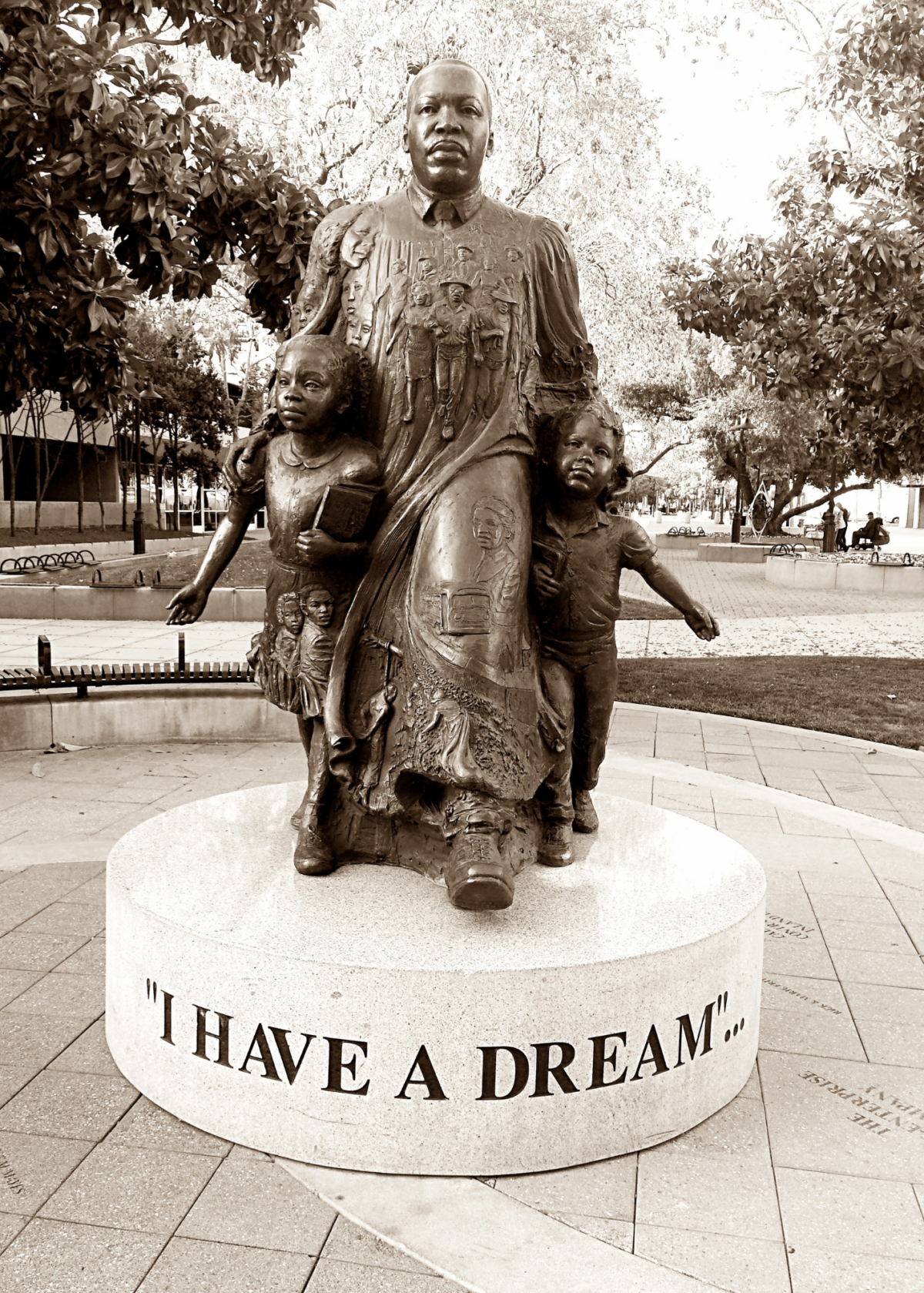

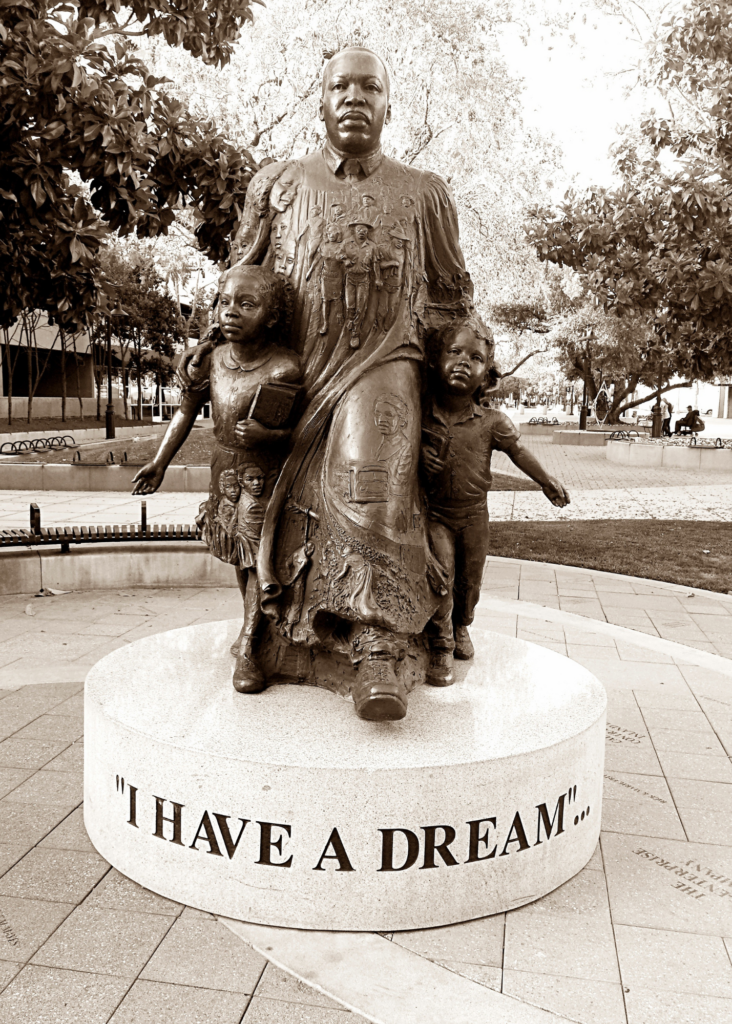

- Go somewhere you’ve never been before, someplace you’ve always wanted to see but never did. In the coming editions of LivingPower, we’ll be highlighting interesting places here in North Carolina.

- Volunteer. It’s good for your soul, your mind, your heart, and your community. NCRGEA is working with Meals on Wheels for a big event in March that you can volunteer to be a part of. More on that to follow.

- Make a new friend — a real friend. Find things you have in common and do things together. One of the benefits of being a member of NCRGEA is the opportunity to meet people you have something in common with, you’re all state or local government retirees. Get your NCRGEA district’s Community Advisory Board, or CAB, to organize social events.

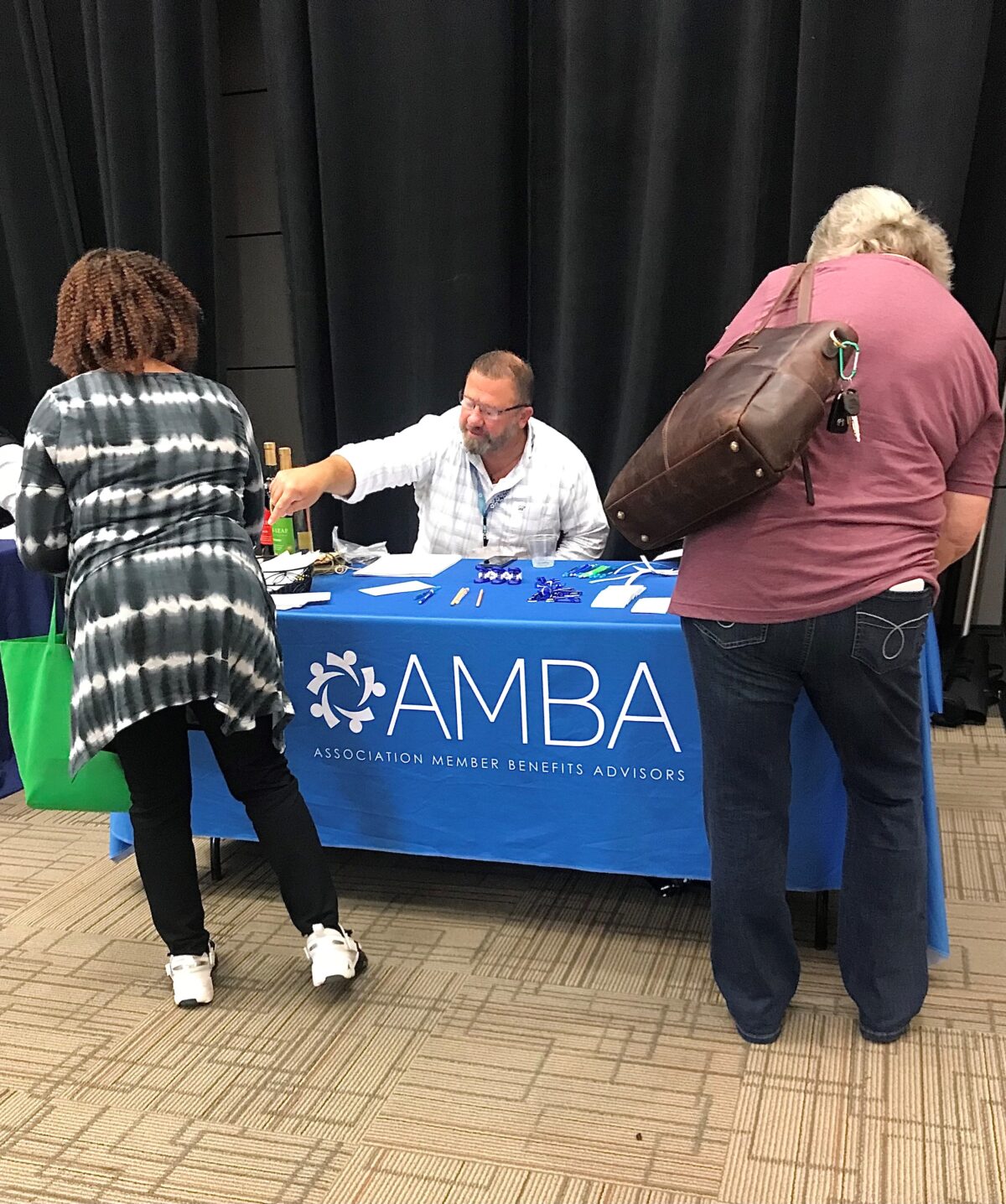

- Make all the doctor, dentist, and other appointments that are so easy to blow off. Take a look at your health coverage. Medical needs can change from year to year, so make sure the coverage you have meets the needs you have now and in the future. Contact our benefits partner AMBA to see if they can assist you.

- Rewatch your favorite movie, or reread your favorite book — and see if there’s now something else that jumps out at you with either age, experience, or simply new eyes. Then tell your new friend about it.

- Go somewhere really nice to eat. Dress up for it. It could be a “date” or a night out with friends, hopefully, ones you met through NCRGEA.

- Try something you’ve sworn all your life that you absolutely hate — but maybe just never really gave a chance.

- Make a conscious effort to thank all the people you might be taking for granted in your day-to-day life.

- Learn how to cook a new meal. Invite people over to share it with you.

- Spend time in nature, whether that’s on a day hike on a nearby trail, or a few days camping with your family and friends.

- Go to a museum, see a band or a sports game live, or watch a play or a musical. Experience culture without the help of technology.

- Give flowers to someone you love and appreciate.

- Reach out to someone you admire. Build a connection. See what you might be able to learn from them — and even how you might be able to help them, too.

- Try to make amends with someone with whom you might have had a falling out. If you can’t fix the relationship, at least let that wound heal as healthfully as possible.

- Ask yourself if you’re happy. And if you’re not, ask yourself what might help you work towards getting there, and then make it happen.

- Give yourself a self-administered fitness test. Consider instituting a tradition in which you challenge yourself to a set of physical tasks to see how you measure up.

- Take your pet to the vet and include blood work in the checkup. It’s a good way to get ahead of any health issues that could arise, ensure your pet is up-to-date on any necessary vaccinations, and get valuable insights into how your pet is doing.

- Find out what your credit score is by getting an annual free credit check. Also, schedule a visit with a financial advisor or your bank to review your money and your plans that may have occurred over the course of the year.

- Drain your hot water heater. It will help it last longer by eliminating any minerals or debris that have built up and could cause the unit to break down.

- Get your home’s carpets, rugs, and upholstery cleaned with steamers, a soapy bucket, a rented machine, or professionals. Other yearly cleanups include emptying the gutters and cleaning the fireplace and chimney.

- Once a year, bring in a professional to check out your car, air conditioning units, furnace, roof, gas appliances, the exterior of your house and pipes. Termite inspections should happen on the regular, too.

- To make sure smoke detectors are always in top form, test them monthly and replace batteries every year.