LivingPower Newsletter, Jan./Feb. 2023

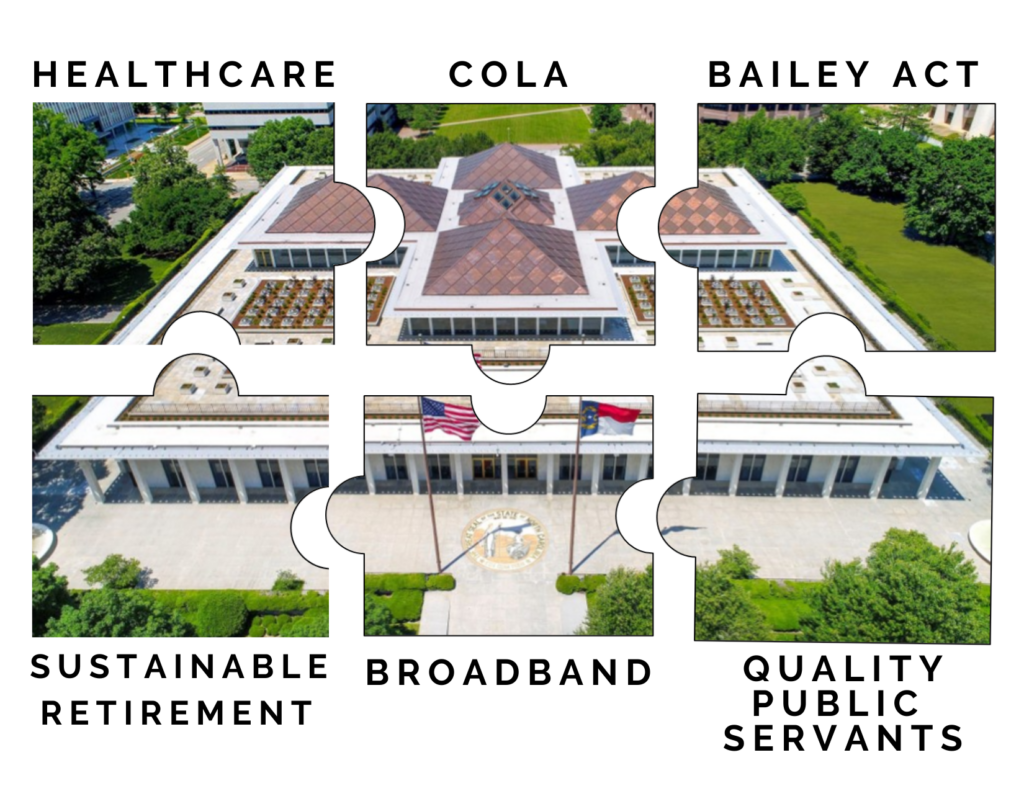

Last October at the North Carolina Retired Governmental Employees’ Association’s Board of Directors meeting, Linda Suggs, Chairman of the Government Relations Committee, presented the committee’s recommendations for 2023 legislative priorities, which the full NCRGEA board unanimously approved. The list consisted of six items that focus on the quality of life of North Carolina’s retired state and local public servants.

Advocating for annual cost of living adjustments for all government retirees, state and local, was their top priority.

In presenting the proposed legislative agenda for 2023, “Working for a COLA for state and local retirees will always be number one on our list of legislative goals.”

“In the past 10 years, retired state employees’ COLA totaled only 2% and local government employee’s COLA increased by less than 1%,” said Tim O’Connell, NCRGEA’s Executive Director. “During this same 10-year period, inflation has eroded buying power by 29.8%, severely undermining North Carolinians’ ability to cover their expenses on a declining value of their fixed retirement income.”

The expansion of the Bailey tax exemption act for state and local government retirees and the

pursuit of other tax exemption opportunities is another of the committee’s priorities.

Under the Bailey Act, if you qualified for the NC state pension system or federal pension system, including military, for at least five years as of August 12, 1989, the money you receive from that pension is considered tax-exempt.

“Expanding the Bailey Act to local government and more state retirees would be a win for all parties involved,” Suggs added. “Our retirees would have more disposable income; this aligns with many political platforms of lowering taxes, and the state’s retirement fund remains sustainable because no additional funds are going out of it.”

During the recent district conferences, this effort was briefed to attendees by NCRGEA’s lobbyists and warmly received by attendees. Comments supporting our expansion efforts were the second most popular comments after increasing COLA.

Another of the committee’s priorities is to strengthen the state’s benefit plan to attract and retain the best and brightest public servants.

This issue is gaining attention. The Raleigh News & Observer ran an editorial on this issue on December 1, 2022. The Op-Ed piece states, “As benefits shrink and private sector wages rise, the state government is struggling to attract and keep workers who provide both basic and essential services. State agencies are reporting vacancy rates as high as 20-, 30-, and 40-percent.”

Linking COLA and the public servant vacancies issues together, NCRGEA’s O’Connell was quoted in the Op-Ed with, “The promise of what a pension would deliver upon retirement is not there the way it was for folks who retired 20 or 30 years ago.”

Two other priorities of the Government Relations Committee actually support each other: increasing in-person and telehealth access, improving health outcomes for retirees, and expanding first, middle, and last-mile broadband opportunities to provide increased, dependable, affordable access to broadband.

“In recent years, we have added improving health outcomes for retirees through increasing in-person and telehealth access and supporting affordable broadband access to our list of legislative priorities,” said Suggs.

Telehealth can allow patients to hold their medical appointments with doctors and medical personnel from their homes. This works best if the home has broadband capabilities.

The committee’s sixth priority is to continue to ensure the state of North Carolina will fulfill its constitutional requirement to fully fund North Carolina Retirement Systems and the State Health Plan.

“The North Carolina Retirement System (NCRS) is widely regarded as one of the best-funded in the nation,” said Frank Lester, Deputy Treasurer for Communications and Government Affairs. “In fact, Moody’s Investors Service reported that NCRS is the best-funded in the nation when looking at its Adjusted Net Pension Liability.

Additionally, a recent “stress test” by The Pew Charitable Trusts concluded that North Carolina’s state pension fund is well-positioned to maintain solvency during tough economic times.”

According to Lester, the State Health Plan is underfunded but getting healthier. Between June 30, 2021 and June 30, 2022, the deficit shrank by more than $7 billion according to a report by The Segal Group.

“Our goals are always focused on maintaining the quality of life for our state and local retirees, who provided such dedicated service to all North Carolinians during their working years,” said Suggs.