By N.C. State Treasurer Dale R. Folwell, CPA

The North Carolina Retirement Systems (NCRS) is the world’s 26th largest public pension fund. It provides retirement benefits for nearly 1 million teachers, firefighters, police officers and other public workers.

Last year, NCRS paid close to $7 billion in monthly benefits to nearly 345,000 recipients.

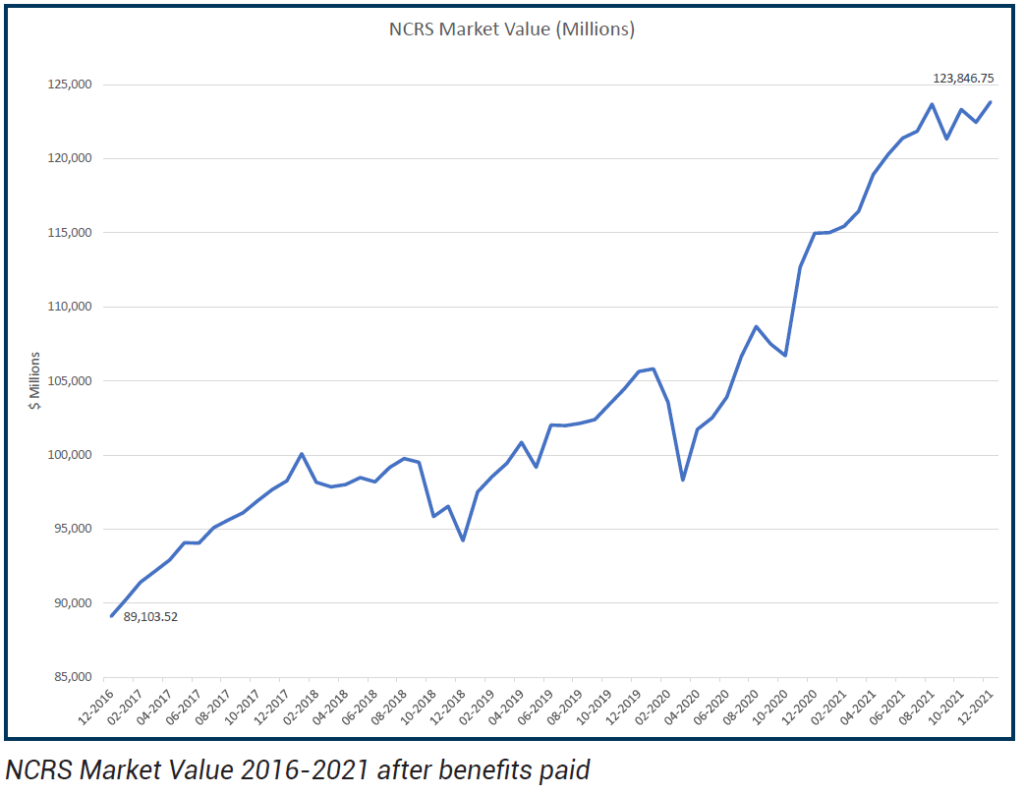

A recent “stress test” concluded that North Carolina’s state pension funds are well-positioned to endure tough economic times. This was put to the test over the last two “pandemic” years and volatile markets; yet NCRS continued to reach historic levels. As of Dec. 31, NCRS was valued at $123.7 billion and maintained the lowest cost when compared with our peers.

The resilience of the pension fund is due to meaningful oversight by the Boards of Trustees (Boards). That is enhanced by the Department of State Treasurer’s (DST) conservative investment strategy while maintaining loyalty to members of the plan that teach, protect and serve the citizens of North Carolina and taxpayers like them.

In December, North Carolina enacted the state’s first comprehensive budget in three years. This included an appropriation for two one-time supplements to benefit recipients of the Teachers’ and State Employees’ Retirement System (TSERS), Consolidated Judicial Retirement System and Legislative Retirement System.

With the budget passing months beyond the fiscal year-end, it was a Herculean effort by our staff to make the first one-time payment (2% of the annual retirement benefit payable as of September 2021).

The second will be paid in October 2022 (3% of the annual retirement benefit payable as of September 2022). This supplement will be paid to members who retired on or before Sept. 1, 2022, and beneficiary recipients living as of Sept. 1, 2022.

Earlier this year, I issued a recommendation for a Local Governmental Employees’ Retirement System (LGERS) supplement, and this was ap- proved by the Board. The money to pay for this comes from the 11.12% net investment gains the system earned in 2020.

Unlike TSERS, whose supplement comes from the General Assembly, the LGERS supplement comes from the fund itself.

The LGERS one-time supplement will be paid in October 2022 (2% of the annual retirement benefit payable as of September 2022).

Regular payments will resume in November.

Many retirees return to service and are subject to an annual earnable allowance. The earnable allowance for 2022 is $37,240 or 50% of your gross pre-retirement salary, whichever is greater.

There are specific guidelines and limitations if you perform work in any capacity for an employer under the same system from which you retired. It’s important that you and your potential employer understand these be- cause of the potential impact on your retirement benefits.

DST, Boards and staff work hard to sustain a pension for people like you.

We are also committed to protecting these benefits for current and future public servants, and their beneficiaries or survivors.

Thank you for all you do and inspiring others to choose a career that serves our state’s citizens.