FROM DOWNTOWN TO DIGITAL

Spring Edition 2024 | Living Power Magazine

How Civic Federal Credit Union and Local Government Federal Credit Union Put Members First

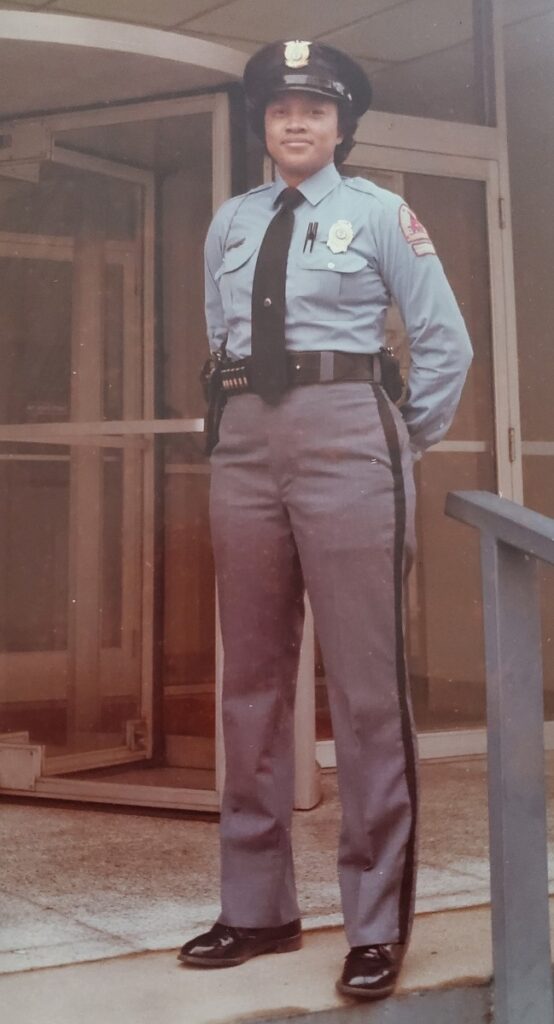

Throughout her career as a certified public accountant, Jeanne Erwin had the opportunity to see the

impact of local government employees up close. Working in a number of roles with the Town of Chapel Hill, Durham County, Durham Public Schools, and the City of Raleigh, Erwin witnessed the

way civic employees work to keep the vital services and programs in their cities running.

“The water we drink, the streets we drive on, the police and fi re protection we rely on, just to name a few—local governments provide these and many other services every day,” she says. “I saw this very clearly in the work that I did during my employment in local government. In appreciation for their service to the citizens of our state, I wanted to give back and help in some way to make the lives of our local government employees and retirees better.”

And Erwin knew exactly how to do that: Serving on the board of directors for the Civic Federal Credit Union and the Local Government Federal Credit Union (LGFCU). She currently serves as the chair of Civic’s board and as treasurer on the LGFCU board. Civic Federal Credit Union and LGFCU are financial cooperatives owned by the institutions’ members. LGFCU was founded in 1983 in relationship with State Employees’ Credit Union to serve local government employees and officials. Civic Federal Credit Union was founded in 2018 by staff and volunteers of LGFCU to meet the needs

of members that they were not able to address in their current LGFCU business model. Civic was built, through listening to local government employees and members, as a digital-first institution to serve those employees and small businesses.

“Credit unions are not-for-profit organizations—this means that profit generated is put back into the

membership, rather than toward payment to stockholders, as in a traditional banking model,” says Ashley Ruffin, chief impact officer, Civic Federal Credit Union and LGFCU. “Th is can show up for the membership in the form of lower rates on loans and/or higher rates on deposits, as examples.”

Civic Federal Credit Union and LGFCU go beyond the basic credit union services in their pursuit to

support local government employees. Th e organizations take an equitable approach to lending, making funds available to those who may be overlooked by traditional banks.

“A high percentage of our loans are made in areas that are underbanked or underserved,” Erwin says. “We work to ensure that all our members have every possible opportunity to get the loans that they need and to have products and services available to improve their financial wellbeing.”

With Civic Federal Credit Union’s digitally-focused model, that means members who may not have a local branch or transportation to an in-person location can use the institution’s robust website or app to apply for loans, open accounts, and perform other financial business. Phone and video call assistance, chat, and education opportunities are available for members who need guidance with the online process.

“Our digital platform is built to modify as technology advances in our financial world,” Erwin says. “We are here for our members—now and in the future.”

Civic Local Foundation

Civic Federal Credit Union and LGFCU are also there for communities across the state. With the Civic Local Foundation, both entities offer student scholarships, nonprofit grants, and other monetary support to local groups and individuals. Th e foundation focuses on bridging gaps in healthcare, housing, human services, and hunger.

“As a values-based cooperative, we strive to help our communities thrive today and tomorrow,” Erwin

says. “Together with partners such as the School of Government, the NC Association of County

Commissioners, and the NC League of Municipalities, we participate in projects to improve our communities and provide scholarships for training programs for local government employees and elected officials.”

Part of Civic Federal Credit Union’s mission to be there for members includes establishing regional branches, as well as shared sites in government buildings and other in-person options. In 2024, Civic will open 11 branches across the state in Ahoskie, Asheville, Charlotte, Durham, Greenville, Hickory, Kernersville, Lumberton, Murphy, Raleigh, and Wilmington.

Those new locations will carry on many of the planet-friendly practices at Civic Federal Credit Union’s LEED Gold-certified Raleigh headquarters, which plays an important role in the organization’s 2020 certification of carbon-neutral status. Civic achieved that through a number of measures, including its energy-efficient headquarters, as well as other operational and transportation decisions designed to reduce their impact on the environment.

“Our commitment is to the triple bottom line—people, planet, and prosperity,” Erwin says. “This means people first, care for our planet, and prosperity for all. This is in our DNA.”

Changes for LGFCU

Change is also on the horizon for LGFCU. The organization will officially become independent of SECU

in June 2025, a move that was intended for LGFCU since its inception. “We have enjoyed a long-standing, supportive, and mutually beneficial relationship with SECU, and are grateful for their service to our members,” Ruffin says. “As two separate credit unions, often our memberships

want and/or need different things, whether that be products and services or delivery channels. The world of financial services is rapidly changing, and our members have many choices in where to do business. Digital-first allows us to give more to the members as fewer branches means lower overhead which means more to invest in new technology and updated services. It’s important that we

offer the products and services that our membership tells us they want, when they want, in the ways they want.”

But no matter how Civic Federal Credit Union and LGFCU evolve in the future, one thing will always remain the same: The organizations’ focus on serving North Carolina local government and their members.

“To put members first means to have our members’ wellbeing at the forefront of every decision that we make,” Erwin says. “Our mission is to improve the lives of our members. This means that we approach every decision regarding our products and services by asking ourselves if this decision will be the best decision for our members.”