Women in Public Service

Spring Edition 2024 | Living Power Magazine

How Cutting Pension Benefits Hits Women Retirees Hardest in North Carolina

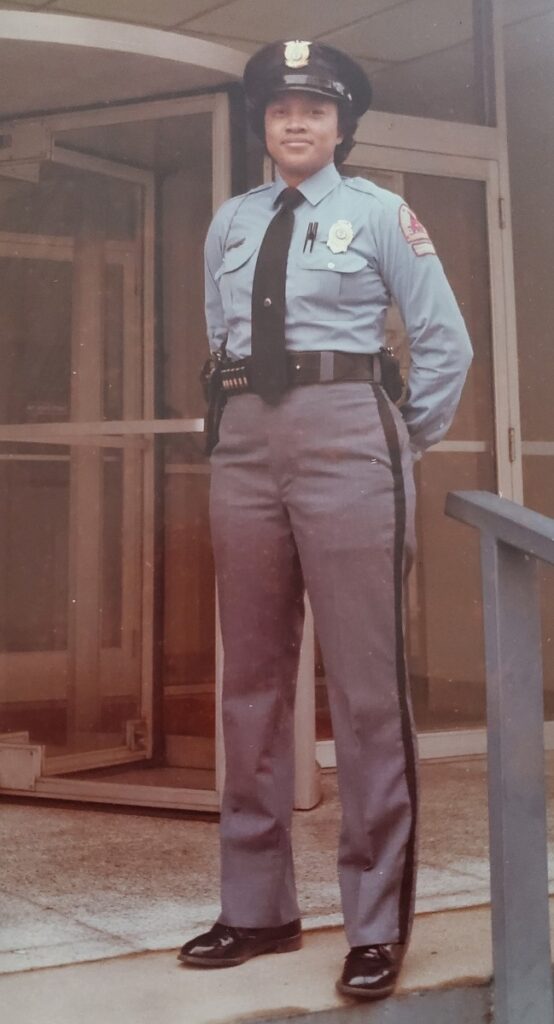

In 1980, Shirley Snelling was a 28-year-old single mother who was tired of being on welfare because her full-time job as a pharmacy technician didn’t pay enough. She applied for a better-paying job with the city of Raleigh, and on her 29th birthday, she joined the police academy to become a Raleigh police officer.

“It wasn’t easy, but I pushed to make it through,” Snelling says. “I went from making $10,000 to $19,000 a year, and it seemed like every six months I was getting a raise. I had never made that much money in my life. And as a police officer, I felt I made a difference in the community and department.”

Snelling worked 19 years with the Raleigh Police until she retired for medical reasons. Throughout her career, Snelling had numerous roles. She served as a patrol officer, responded to calls from people reporting crimes, and worked as an undercover officer. In community service roles, she helped set up neighborhood watch programs and worked with schools as a Drug Abuse Resistance Education Program (DARE) officer.

“That was probably one of my most rewarding positions I had there, interacting with the fifth graders and the children,” Snelling says. “(The kids) were only looking for love.”

And the pay and benefits brought Snelling out of poverty. “It helped me to live a productive life,” she says. “I didn’t get too far over my head in debt, and the pension plan and Social Security that I get help quite a bit.

How do pension benefits impact women?

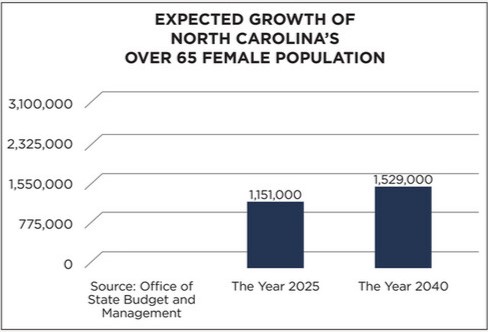

Women now make up the majority—

52%—of North Carolina’s public service

workforce, retirees, and the population

of North Carolina as a whole. With the

Office of State Budget and Management

estimating the number of women in

North Carolina over the age of 65 to grow

by 378,000, or 33%, over the next 15 years, the number of female governmental

retirees will likely reflect similar percentage growth rates.

In January 2024, the state retirement plan had 370,881 people drawing pensions, according to the State Treasurer’s Office. Of these, 227,240, or more than 61%, were women. It said 143,237 (almost 39%) were men. Further, a 2020 US Department of Health and Human Services study indicated that one in three women over 65 lives in a single-person household compared to one in five men in the same age demographic.

Interestingly, marriage may have a mixed impact on a woman’s retirement.

“When a male and female married couple retires, the husband is more likely to get sick, run up high medical expenses, run up nursing home expenses, and die before the wife does,” says Tyler Bond, research director at the National Institute on Retirement Security. “That could leave the wife with little money left for her final years. “Whereas, if she had a pension—either that she earned on her own or that she received when her spouse died— then that still provides that reliable monthly benefit that she can’t outlive. So that would make it easier for her to maintain her standard of living.”

A study published in September 2023 by retirement researcher Nari Rhee of the University of California Berkeley Center for Labor Research and Education said retired women in households where they or a family member have a pension are better off economically than those in a household where no one has a pension. Specifically, 88% of women in households with pensions were at least 200% above the federal poverty level, compared to only 58% of women without pensions who were 200% above the poverty level. The 2024 federal poverty level for a one-person household is $15,060. State Treasurer Dale Folwell, who oversees the state pension and health plans, says pensions are critical for female employees and retirees.

“I can’t do anything about the fact that women were underpaid for a large part of my life,” he says. “So, I think this retirement benefit is more important than ever to someone who has been underpaid and is going to live longer.”

As North Carolina’s leaders reduce and remove retirement benefits offered to state employees, all will feel the impact, but more so women, due to historically lower lifetime pay for the female workforce. Combine this with the fact that some women may have reduced career longevity due to caretaking duties at various times in their lives, and you begin to see the larger concern. A 2020 study conducted by AARP found that six out of 10 caretakers of an aging spouse or parent were women.

With the aging of North Carolina, this noble and needed caretaking role will continue to grow. Meanwhile, the lower pay and more time away from work will continue to make it harder for women to build a retirement nest egg.

What retirement benefits have North Carolina lawmakers eliminated?

Current state retirees and most future retirees are grandfathered into the state retirement benefits that existed when they were hired. These retirees will continue to receive the retirement benefits that have been in place for decades. But as time goes on, a growing number of newer state employees—highway patrol troopers, hospital employees, teachers, transportation workers, park rangers, court clerks, and many others who bring services to the public—are getting left out.

Why?

First, the North Carolina General Assembly voted in 2017 to stop offering retiree health insurance to state employees hired on or after Jan. 1, 2021. People hired prior to that date get state-provided health insurance when they retire; those hired after will not.

Second, in 2023 the General Assembly voted to quit offering pensions to new employees at UNC Health and ECU Health, the regional hospital systems based at The University of North Carolina at Chapel Hill and at East Carolina University in Greenville.

As of Jan. 1, 2024, new employees at UNC Health and ECU Health may participate in investment-based retirement programs their agencies offer. But they are barred from the Teachers’ and State Employees’ Retirement System (TSERS).

That means fewer people will contribute 6% of their salaries to the retirement system pension. And UNC Health and ECU Health won’t contribute at all.

How important have these benefits been for women who have retired from state and local government service in North Carolina? Living Power spoke to two more retirees for their thoughts.

Henrietta Saunders: Benefits keep good people

When Henrietta Saunders was in her 40s, she left a job at a bank for better pay as a Mecklenburg County sheriff’s deputy. She was assigned to the county detention center and stayed more than 20 years, striving to keep peace among inmates who were prone to fight with each other and assault the detention officers.

“It was trying, but my good days outweighed my bad days,” Saunders says. “You learn people skills, you learn to trust your instincts. And so you learn how to communicate more effectively, too. Because if you can talk somebody out of something, or somebody down from something, that was a good day.”

Saunders rose to the rank of captain and retired in August 2021. Now she enjoys the freedom to spend time with her grandchildren and participate in water aerobics, line dancing, and other activities. She thinks that if she had stayed in the private sector, she would have worked her way up to better pay and gotten investment benefits for retirement. But Saunders says the government’s pension benefits are an important tool to attract good people and persuade them to stay for the long term.

“(When benefits are reduced) I think you end up having a higher turnover rate,” she says, noting that’s a problem in a jail. Inmates quickly recognize new deputies and try to play psychological games with them. “They can read most new people like a book,” she says. “They know who’s afraid, they know who’s going to do the job. They know who they might approach, and then they know who not to approach.

“And so that turnover rate, when you lose that experience, you lose a lot. Because now you’ve got to train somebody to get up to their level of competence in order to do that job, in order to be successful at it.”

Chris Smoot: 46 years at the county courthouse

Chris Smoot joined the Cumberland County Clerk of Superior Court office in 1973 and retired in 2019, 46 years later. The hours were long, and when she started, the salaries were low. “So very low, it affects your Social Security,” Smoot says. She worked part-time jobs to pay down debts and build up savings.

“It really is hard for a woman, for a single person who doesn’t have people to share expenses with,” she says. “And that was my case. So I took extra care to plan for my retirement.”

Though Smoot worked her way up through the ranks, and for a time served as the interim Clerk of Superior Court when the elected clerk left mid-term, she says that in 46 years she never made more than $59,000 per year. Smoot says she’s grateful for the retirement health plan, because she uses that as supplemental health insurance to pay for things that Medicare doesn’t cover.

Employee turnover became challenging at the Clerk of Court office, Smoot says. Staffers need at least six months to get comfortable with new job duties, and she says cutting retirement benefits would make the turnover worse. Smoot thinks she wouldn’t have stayed 46 years, if not for the pension. “I wouldn’t have stuck it out,” she says.